Solutions

3D Secure

Payment Authentication Solutions for Acquiring and Issuing Banks

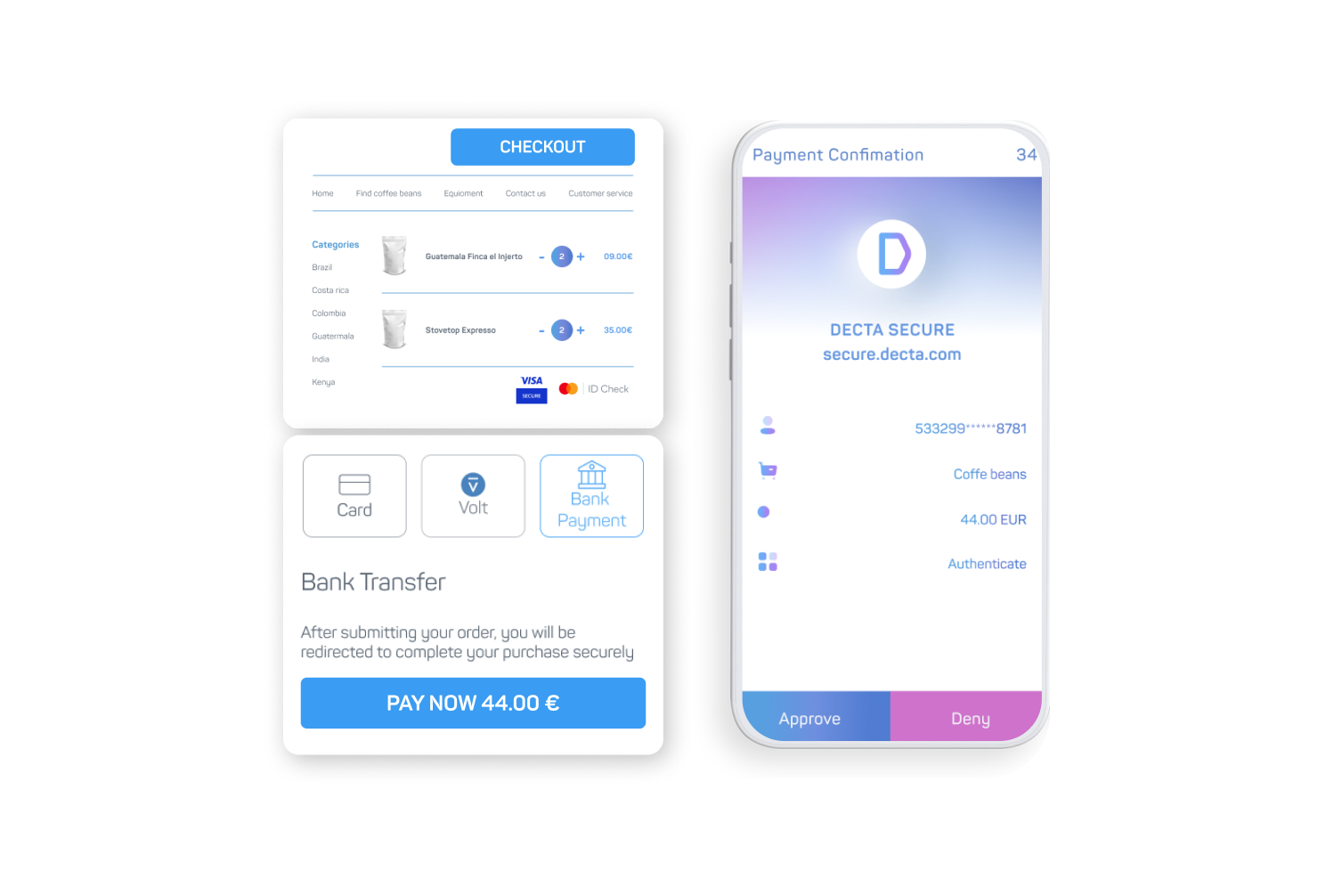

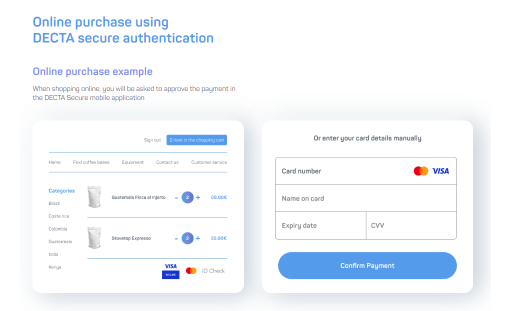

EMV 3D Secure (3DS2) is an industry standard cardholder authentication protocol developed to protect online payment data and simplify consumer payment experience. It is promoted by major global card networks and mandated by financial authorities for merchants and financial institutions operating in the EEA and the UK.