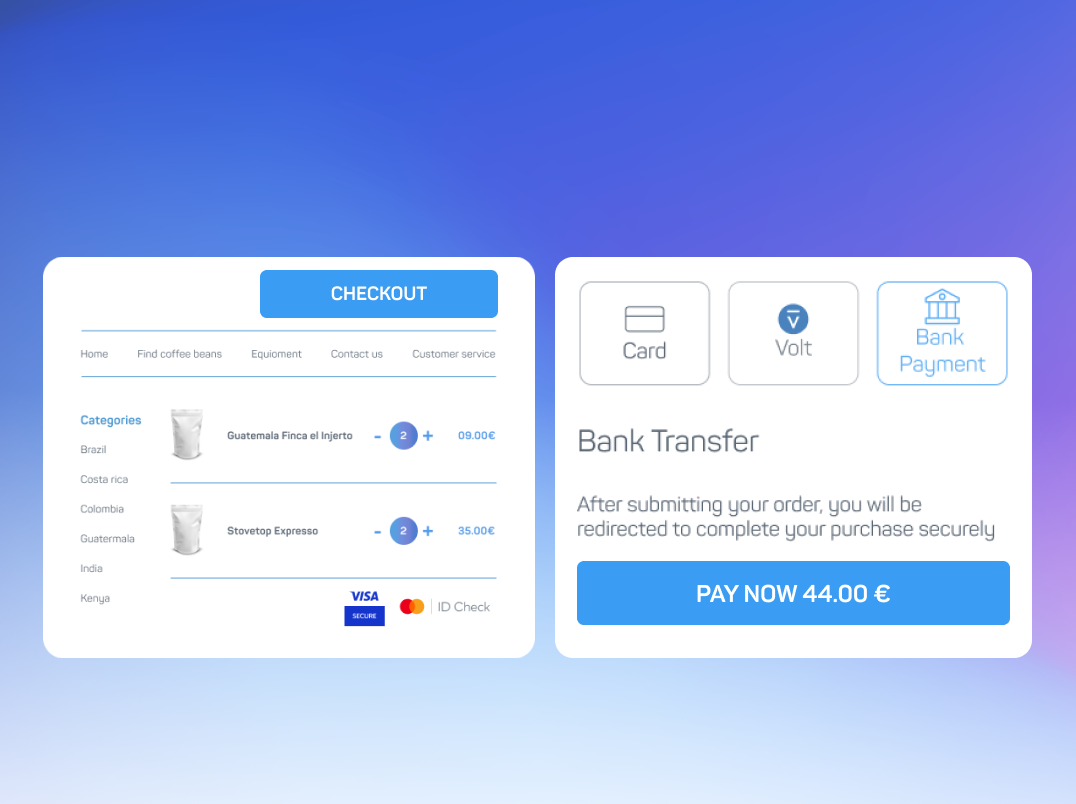

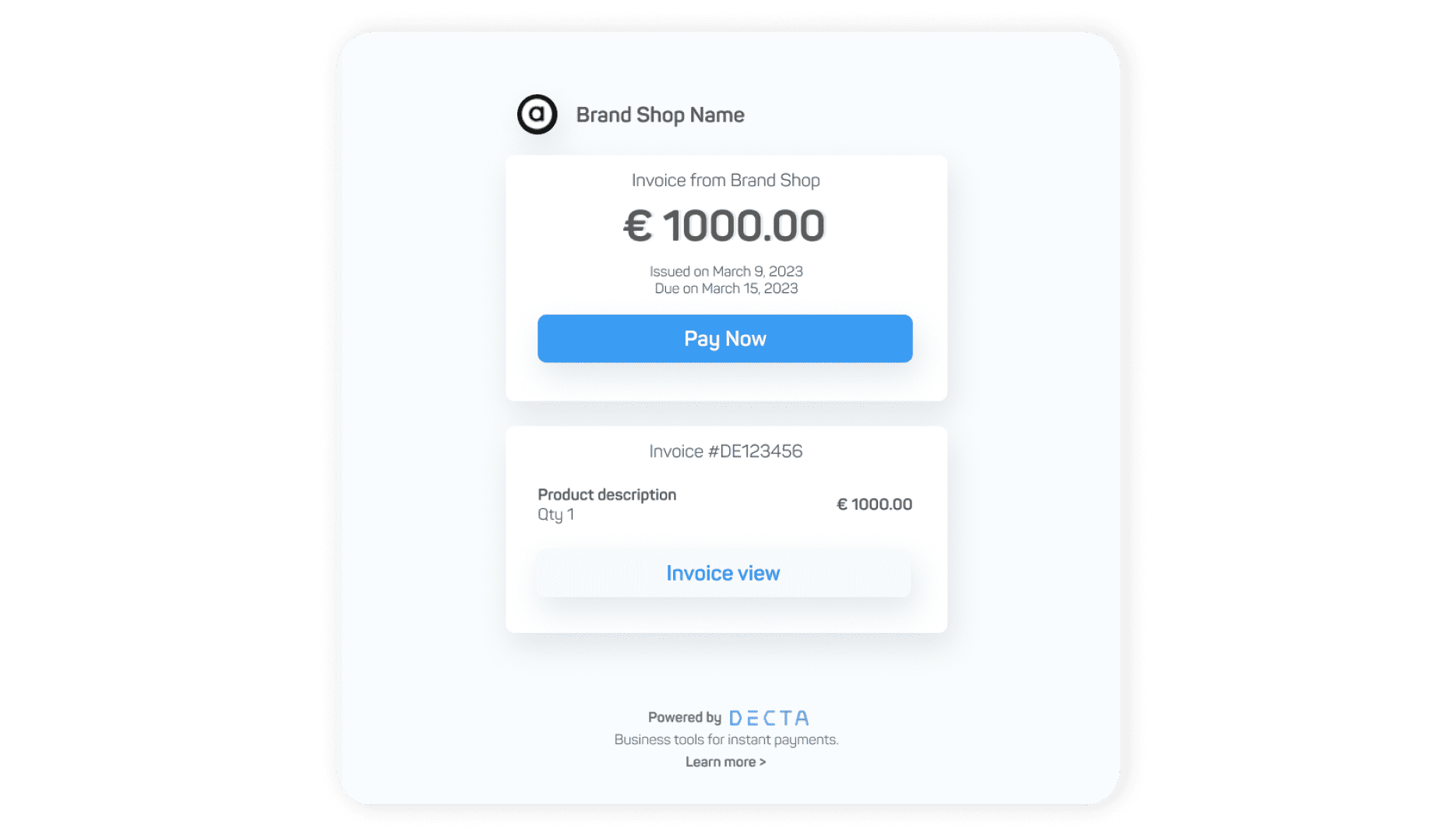

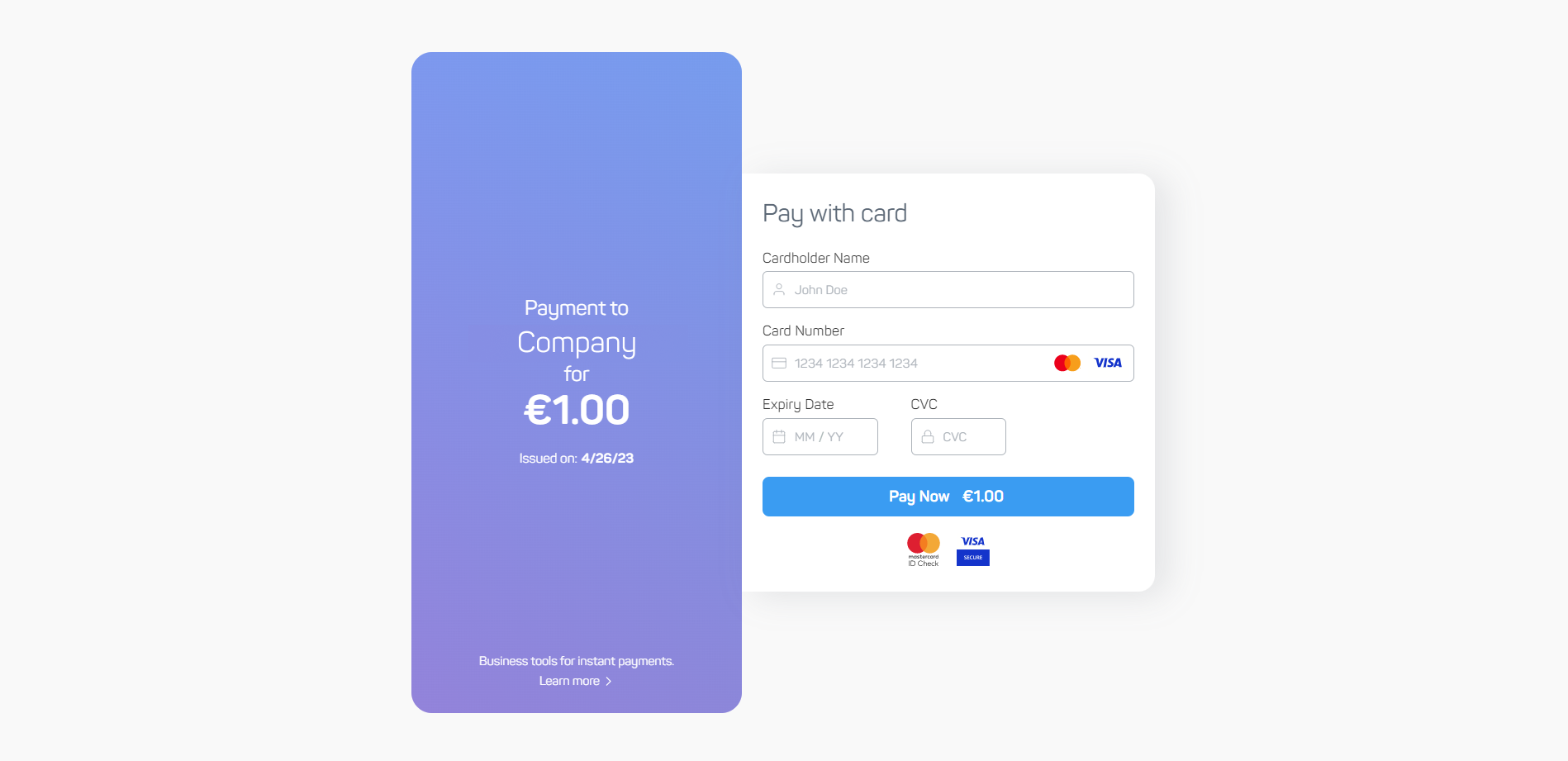

Today’s customers expect more than just simplicity, security and with every payment across all channels.

Raise your game by delivering seamless payment journeys that grow loyalty, retain customers and increase conversions.

Our payment capabilities are fully 3D Secure v.2 approved and offer additional convenience including:

&

&

Level 1

Level 1