DECTA Fintech Fast Track:

Access to DECTA’s advanced payment processing with no setup fees and reduced monthly pricing.

The DECTA Fintech Fast Track innovation program

Pilot-centered collaboration program designed to help emerging fintechs launch and scale their card issuing or acquiring business faster.

- Building a card acquiring or card issuing business comes with its challenges - regulatory approvals, infrastructure setup, and operational complexities.

- At DECTA, we know the hurdles because we've been through this many times with our clients and we know how to succeed

- That is why we are excited to introduce the DECTA Fintech Fast Track - a program designed to help emerging card Acquirers and Issuers enter the market faster, stay competitive, avoid pitfalls, and launch groundbreaking products that redefine the industry.

- The selected companies will gain access to: access to DECTA’s advanced payment processing with up to €100K in infrastructure and implementation value, reduced monthly pricing, expert guidance, and industry connections.

Our team has gone through this process multiple times with clients, and we know how to succeed

Hands-on guidance

Industry expertise

Strategic connections

Whether it’s technical setup, operational best practices, or navigating partnerships, our team is here to share real-world insights and support you at every step.

Each quarter, we will select

1X Acquirer

And

1X Issuer

to receive DECTA’s payment processing with no set up fee and exceptional discounted monthly fee.

How It Works

01

Apply for the Program

Fill out the online form with details about your business.

02

Eligibility Review

If your company meets the criteria, a DECTA specialist will reach out for further discussion.

03

Quarterly Selection

At the end of each quarter (January, April, July, October), we will select one Acquirer and one Issuer to join the program.

Who Can Apply?

To qualify for the DECTA Fintech Track, applicants must:

- Have an EMI, PI or similar license and be legally incorporated business in Europe, UK, APAC, MENA or LATAM regions

- Have applied or ready to apply for Visa and/or Mastercard and/or UnionPay International membership for card issuing or acceptance

- Have applied or considering to apply for Mastercard Fintech, Visa Fast Track programs

- To have a vision to challenge existing Fintech market with new, ambitious products and grow into challenger-bank

- To have a ready-to-execute business plan

Why Join?

Lower Initial Costs

No set-up fee and reduced monthly pricing

Industry Expertise & Support

Get real guidance from a team that understands the process

Accelerated Growth

Access the right tools, connections, and payment infrastructure to scale faster

Why DECTA?

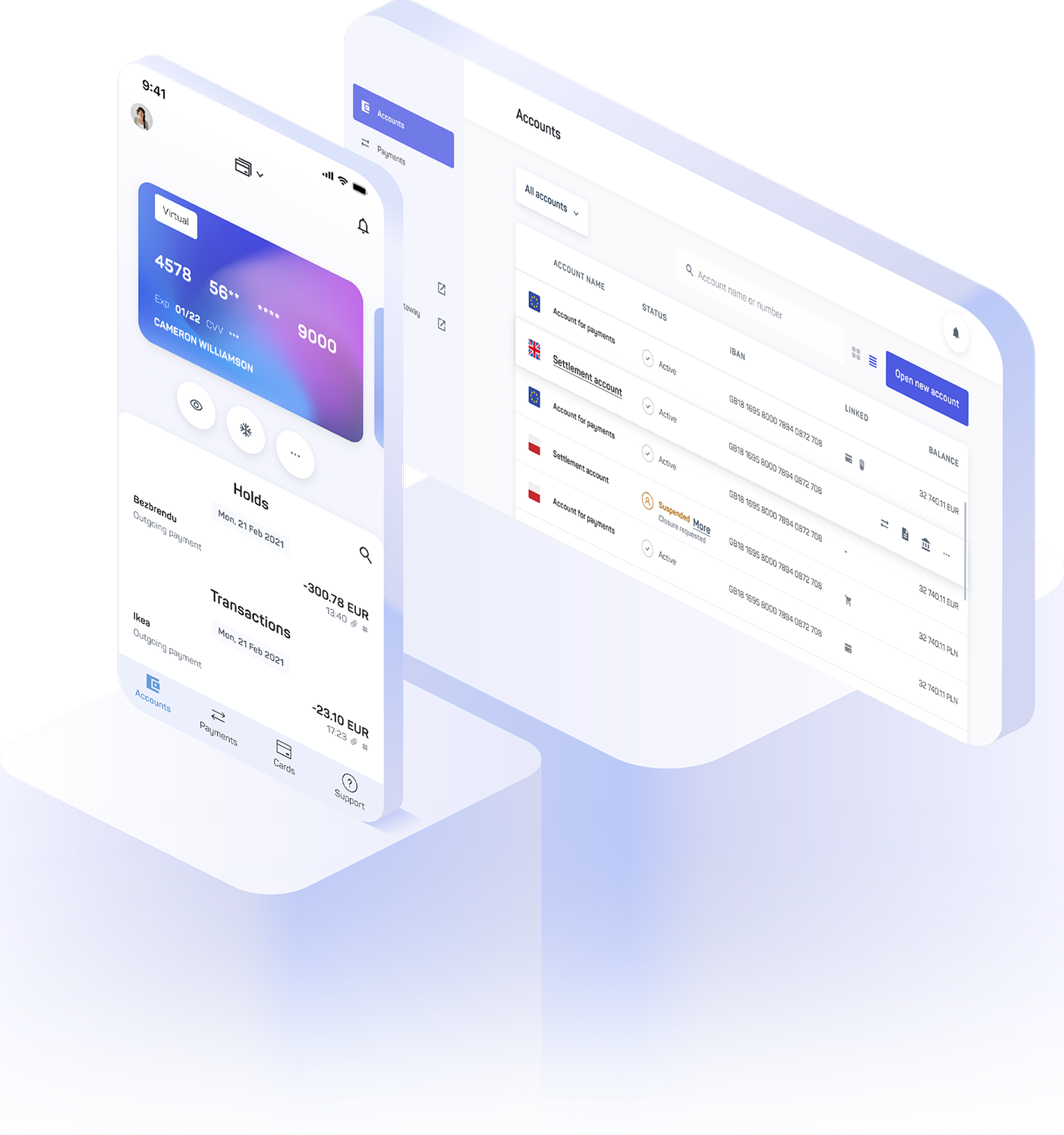

- Advanced Infrastructure: Robust technology to support card acquiring and issuing businesses.

- Seamless Integrations: Easily connect with existing systems for a smooth setup.

- Expert Support: Guidance from industry professionals to help you scale efficiently.

- Broad API Selection: Automate processes with a comprehensive API suite.

- Advanced Reporting & Settlement Tools: Gain full visibility and control over transactions.

- Direct Connections: Fast-track your setup with direct access to Mastercard, Visa, and UnionPay International.

- Accelerated Market Entry: Streamline operations and launch faster with DECTA’s expertise.

Scale your Acquiring or Issuing business

Apply now and get the opportunity to scale your acquiring or issuing business with DECTA’s industry-leading payment processing solutions.