Payment Scenarios

Anticipate a variety of payment scenarios and build stronger relationships with your customers while maintaining a more future-proof business model.

Anticipate a variety of payment scenarios and build stronger relationships with your customers while maintaining a more future-proof business model.

Recurring payments play a key role in the success of the subscription business model, benefitting both merchants and customers by:

Use cases

Achieve higher conversion rates by allowing consumers to bypass the need to enter their details and skip authentication to purchase with one-click payments.

One-click payments are a form of card-on-file transactions initiated by the cardholder. They tokenize the cardholder’s data and vault it for future secure processing.

Use cases

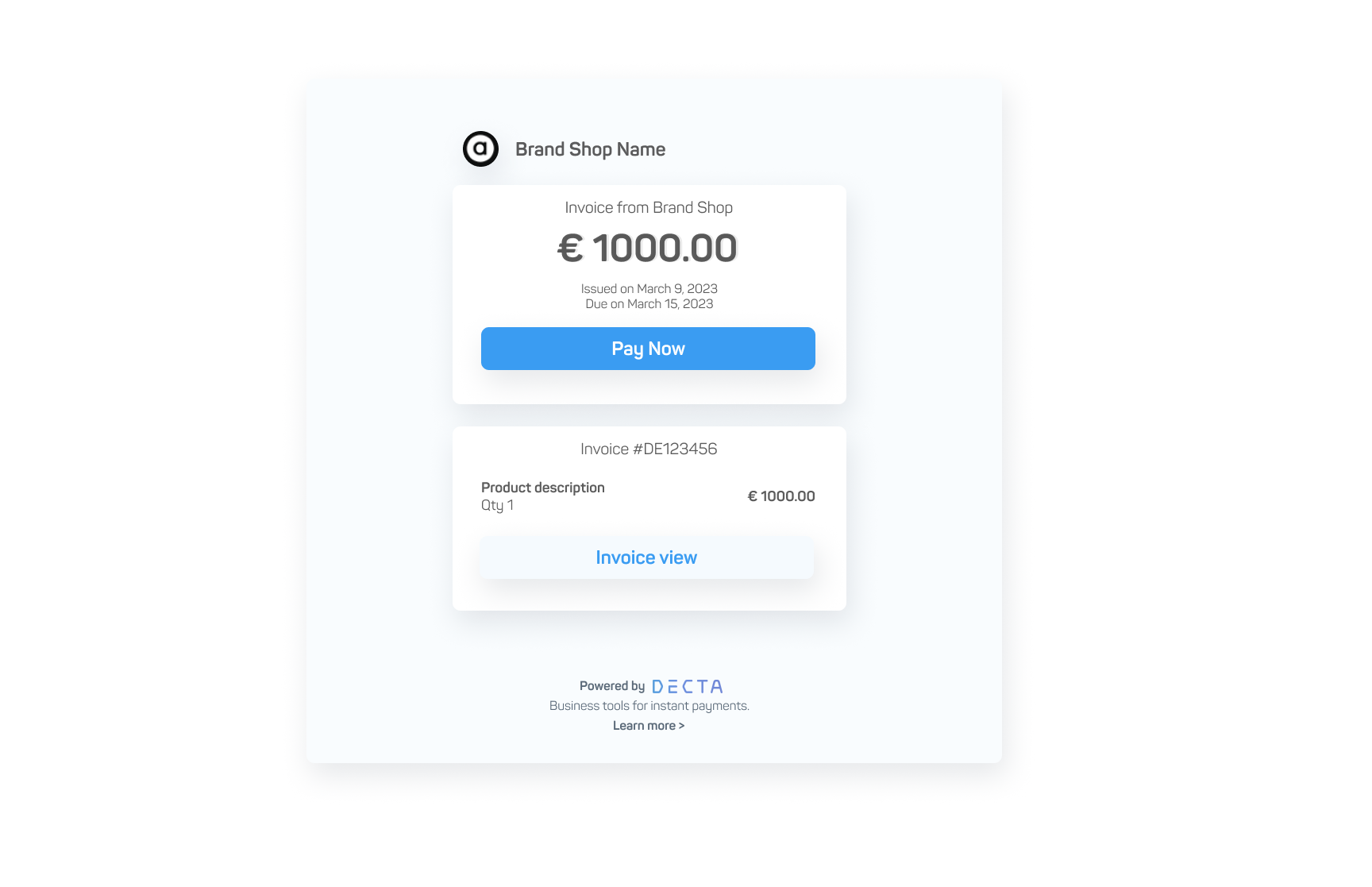

There is no need to have a website, app or a POS terminal to accept payments.

Generate a payment link and send it directly to cardholders for an instant online payment via a dedicated payment page.

Paylinks can be shared via multiple digital channels, including social media, invoices, QR codes, email, chat and SMS.

Pay By Link is a convenient tool for omnichannel and contextual commerce that allows merchants to charge each customer precisely based on their requirements and the service received.

Example use cases

Enable real time fund transfer between business and cardholder bank accounts with person-to-person (PSP) and business-to-person (BSP) payments using Original Credit Transaction (OCT).

Visa Direct enables P2P money transfer, bill pay, disbursements, and cross-border remittances directly to eligible credit, debit, or pre-paid cards.

MoneySend enables issuers connected to the Mastercard network to perform real-time money transfers worldwide.

Use cases

Acquire payments without the need to see the customer in person. MOTO payments allow transactions to be completed over the phone or by post.

Transact with customers who are offline or not comfortable with online payments.

MOTO is easy to set up and use, offering businesses a quick and convenient way to capture payment information and process transactions remotely from anywhere in the world, 24/7.

Example use cases

Adjust your statement descriptor on a per-transaction basis. Dynamic descriptor helps merchants create clear and accurate billing descriptors that best suit your business.

Avoid ambiguity and prevent disputes and chargebacks by helping customers better identify charges on their account with more informative descriptors.

Example use cases

Exchange detailed industry-specific transaction data with acquirer banks from travel data.

Travel data provides merchants and banks with valuable insights for their business intelligence and analytics.

It is particularly useful when transactions require careful cash flow planning due to logistical complexity or other factors.

For the travel industry, flights are often booked well in advance, include various transfer and return scenarios, and are frequently subject to changes in rescheduling and cancellation.

Other verticals, where business and businesses and banks require a more in-depth source of customer transaction data can also benefit from this.

Example use cases

Reversals and refunds offer a way to address dissatisfied customers and erroneous transactions. They also help minimize the risk of disputes and chargebacks.

Authorization reversals are performed shortly after a transaction has taken place, but before money has been withdrawn from the cardholder’s account.

A refund applies when a transaction has been settled and the funds have been transferred to the merchant's account.