Solutions

IC++ Pricing

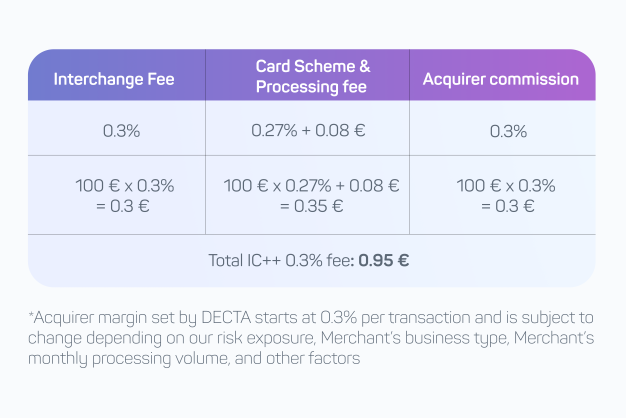

IC++ (Interchange plus plus) is one of the most competitive payment pricing models. It is widely adopted across Europe, North America, and other key regions.

IC++ offers a fair and transparent per-transaction price formation that is directly aligned with criteria set by major global payment networks, such as Mastercard and Visa.