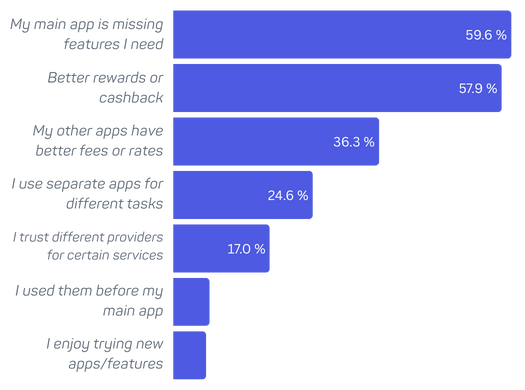

The survey’s multiselect question on “Why do you use other financial apps?” reveals that the top reasons are unmet needs in the primary app and seeking better deals elsewhere. The #1 reason (cited by ~60% of respondents) was “my primary app lacks certain features I need.” Almost as many (58%) said they use others because “secondary apps offer better rewards or cashback,” and about 36% seek out “better fees or exchange rates” in additional apps (e.g. for currency exchange or international payments). Other notable reasons included using different apps for specific tasks (25% – like having separate apps for budgeting or crypto), and a minority keep multiple apps due to trust and reliability concerns (17% wanted different providers for different services) or simply personal preference (only ~6% enjoy trying new apps).

Wallet Fatigue 2025: Why Users Rely on Multiple Finance Apps

This study examines why consumers use multiple digital wallet and banking apps, highlighting key feature gaps, user frustrations, and how tech proficiency influences app satisfaction and consolidation habits. Insights are based on survey data from 1,500+ users and 50,000+ app reviews.

Missing features are the top reason users add a second finance app

60% cite feature gaps in their main app

Security, integration, and budgeting are the most commonly missing features

Each cited by over 45% of users

Advanced Tech Users are the most satisfied with a single financial app

85% report being very satisfied

Most users struggle to remember where key info is stored

80%+ report at least occasional confusion

What drives people to maintain multiple financial apps?

- 60% add apps due to missing features in their primary app.

- 58% seek better rewards or cashback.

Reliability & Support: A Hidden Driver of “Second-App” Adoption

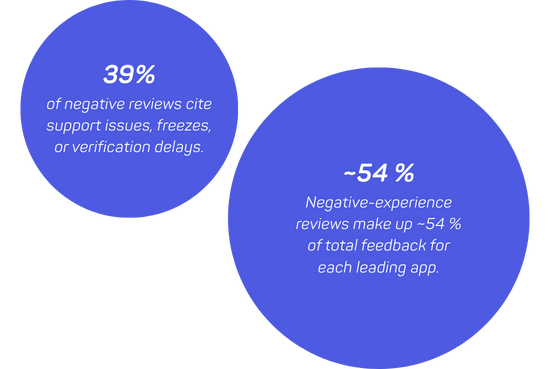

App review sentiment shows that frustration with day-to-day reliability—not just missing features—pushes consumers to keep a back-up finance app. Across the top five UK-EU digital banks, 39 % of all negative reviews cite poor or unresponsive customer support, unexpected account freezes, or lengthy verification hurdles. The share is remarkably consistent from app to app, underscoring that every provider generates a steady trickle of “support horror stories.” On average, 54 % of each app’s total reviews are negative experience complaints—ranging from suspended accounts to slow dispute resolution. Because users know these issues can strike any platform, many keep a secondary app as insurance: if one wallet locks up or support goes silent, funds and day-to-day payments can still flow through an alternative.

Explore the press release and visual highlights

Get the official press release and view key data visualized in infographics designed for media use and sharing.

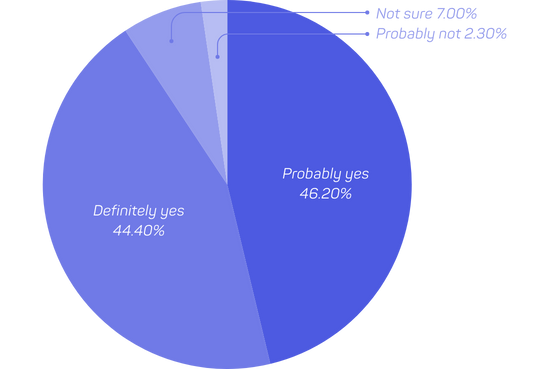

Multiple Apps: Necessity or Personal Choice?

This study suggests having multiple financial apps is predominantly a forced necessity rather than pure personal choice. The clearest evidence is a hypothetical question: “If your primary app added all the features you need at no extra cost, would you stop using the other apps?” An overwhelming majority – about 91% answered “yes” – said they would gladly consolidate everything into one app if it met all their needs. Only ~2% said they probably would not drop the extras, and the rest were unsure.

In other words, nearly all multi-app users are maintaining multiple services reluctantly, only because no single app fully satisfies their requirements.

91% would switch to one all-in-one app.

Only 2% would keep using multiple apps.

Key Feature Prompting a Second App

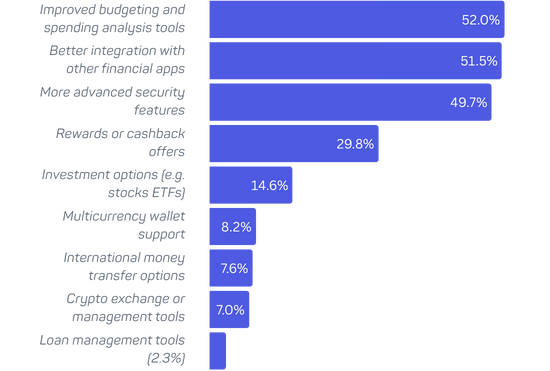

The data points to budgeting and analytics tools as the single most critical feature gap. Among users who supplement their main app, over half (≈52%) said they feel budgeting/spending analysis features are missing in their primary app – the highest of any feature shortfall. This suggests that many users install a dedicated budgeting app or turn to a bank/wallet known for better budgeting features as their secondary tool.

Yet, when users describe what makes a digital banking app their primary choice, budgeting ranks only fourth. Features that carry more weight in defining a “main” app include:

International transfers

Multi-currency accounts

Virtual & physical cards

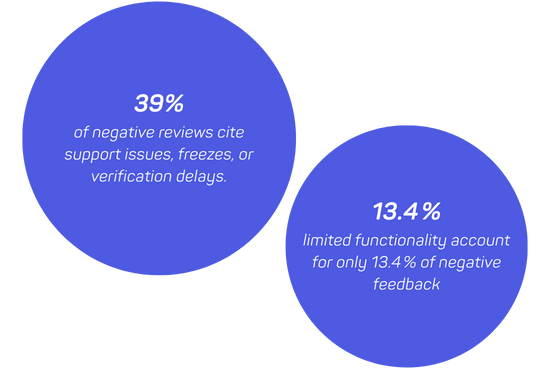

Other Notable Pain Points

Trustpilot reviews show that operational frustrations often outweigh missing features. Nearly 39 % of all negative reviews mention poor or unresponsive customer support, account freezes/fund holds, or verification and bureaucratic hurdles. By comparison, complaints about limited functionality account for only 13.4 % of negative feedback.

- Support / freezes / verification: 39 % of negative reviews

- Limited functionality gaps: 13.4 % of negative reviews

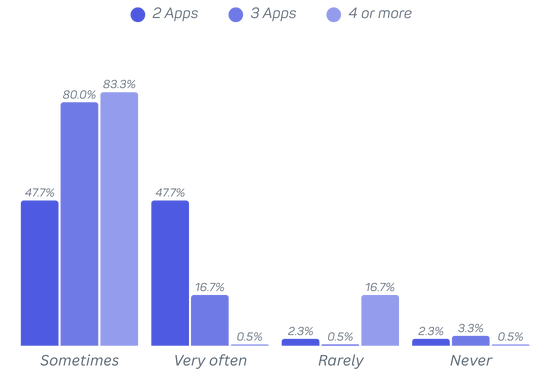

Does having more apps make it harder to remember where things are?

Among users with two apps, 48% report having trouble remembering which app has the information or function they need “very often,” and another 48% say it happens “sometimes.” For users with three apps, 80% report “sometimes” having trouble, and 17% say it happens “very often.” Among users with four or more apps, 83% say it happens “sometimes,” and 17% say “rarely.”

48% of two-app users: “very often,” 48%: “sometimes”

80% of three-app users: “sometimes,” 17%: “very often”

83% of four-app users: “sometimes,” 17%: “rarely”

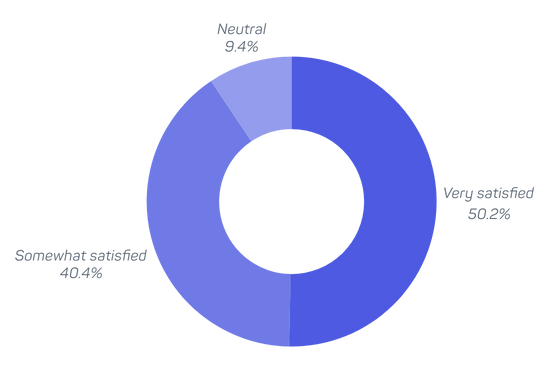

How satisfied are users with the features in their main financial app?

Across the full sample, half of respondents (50.3%) reported being “very satisfied” with the range of features in their main financial app. Another 40.4% were “somewhat satisfied,” and 9.4% were neutral. This satisfaction level reflects users’ perception of their primary financial app, regardless of whether they use additional apps alongside it.

50.3% are “very satisfied” with their main financial app

40.4% are “somewhat satisfied”

9.4% are neutral

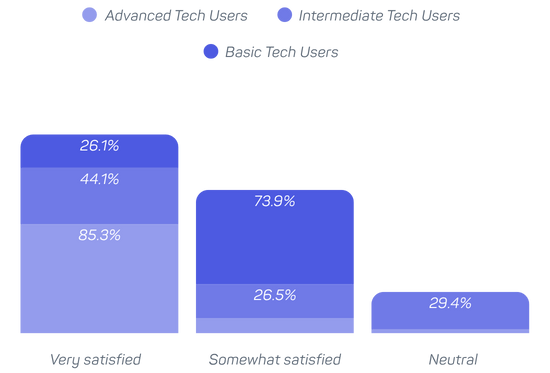

Are satisfied single-app users more or less tech-savvy than others?

Among single-app users who reported being “very satisfied” with the range of features in their main financial app, a large majority—85.3%—identified as Advanced Tech Users. Just 11.8% considered themselves Intermediate Tech Users, and only 2.9% described themselves as Basic Tech Users.

In contrast, among those who were only “somewhat satisfied,” 73.9% identified as Intermediate Tech Users and just 26.1% as Advanced. These results suggest that the most satisfied single-app users tend to be those with the highest level of tech confidence.

- 85.3% of “very satisfied” single-app users are Advanced Tech Users

- 11.8% are Intermediate

- 2.9% are Basic

Do users who rely on a wallet app for everyday payments also use other apps?

Among users who identified daily spending as their main financial app activity, 57.5% use only one app, while 42.5% use two or more. Specifically, 36.2% of daily users rely on two apps, and 6.2% use three. This indicates that although many daily users manage with a single app, a significant portion still use additional apps to cover functions their main app may lack.

57.5% of daily users rely on one financial app

36.2% use two apps

6.2% use three apps

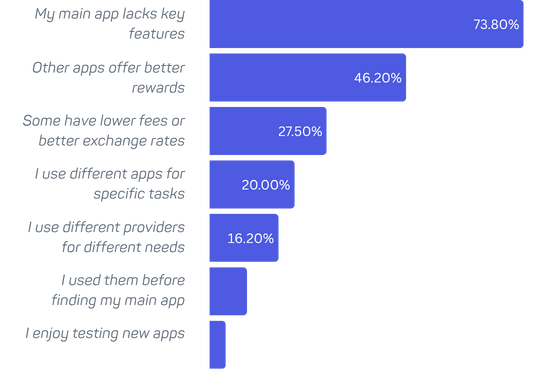

What drives daily spenders to maintain more than one financial app?

For daily users, the most common reason for adopting additional apps is unmet needs in their primary one. Nearly 74% said their main app lacks certain features. Almost half (46.2%) are drawn to secondary apps for better rewards or cashback offers, and 27.5% are motivated by lower fees or better exchange rates. A sizable segment—20%—use multiple apps to separate tasks like crypto, investments, and budgeting. Other reasons include provider trust (16.2%), legacy use (8.8%), and app curiosity (3.8%).

73.8% say their main app lacks needed features

46.2% use others for better rewards or cashback

27.5% turn to secondary apps for lower fees or better exchange rates

20.0% need different apps for specific tasks like crypto, investments, or budgeting

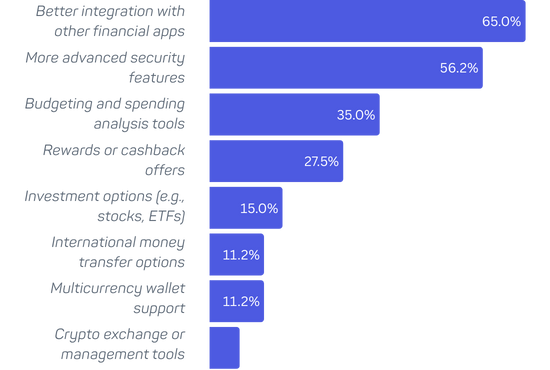

What key features do daily spenders feel are missing from their main financial app?

Daily users most commonly report missing integration, security, and budgeting features in their main app. About 65% say they want better integration with other financial platforms, and over half (56.2%) feel their app lacks advanced security tools. Budgeting and spending analysis is also a notable shortfall for 35% of respondents. Other frequently mentioned gaps include rewards or cashback (27.5%), investment capabilities (15%), international transfers (11.2%), and crypto tools (6.2%).

- 65.0% want better integration with other financial apps

- 56.2% cite missing advanced security features

- 35.0% say budgeting tools are lacking

- 27.5% want rewards or cashback options

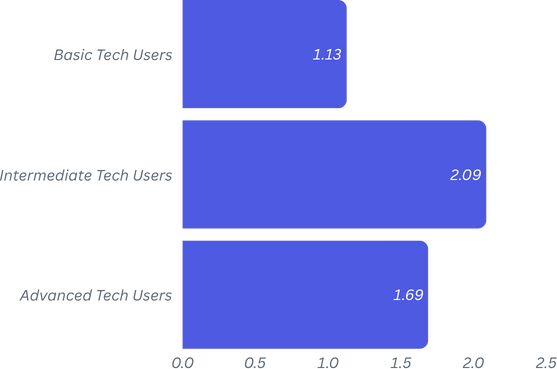

Are tech-savvy users using more or fewer apps?

Users with different levels of tech proficiency show distinct behaviors in how many financial apps they manage. Intermediate Tech Users tend to juggle the most, averaging about 2.1 apps—more than any other group. Advanced Tech Users average slightly fewer at 1.7 apps, suggesting they may be more effective at consolidating tasks within a single platform. Basic Tech Users use the fewest, averaging just 1.1 apps, typically sticking to one core tool.

Interestingly, over 35% of Intermediate Tech Users operate three or more apps, the highest among all groups. Meanwhile, nearly half of Advanced Tech Users manage everything with just one app, indicating they may be power users who get the most from a single solution.

Intermediate Tech Users average 2.1 apps

Advanced Tech Users average 1.7 apps

35% of Intermediate Tech Users use 3 or more apps

49% of Advanced Tech Users rely on one app

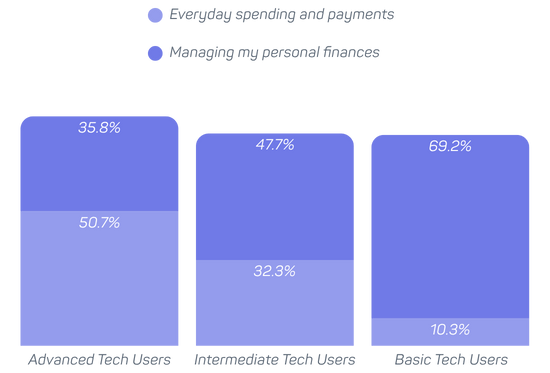

App usage by tech proficiency

Across all tech proficiency levels, two main purposes dominate: everyday spending and payments and managing personal finances. These are the top use cases for Advanced, Intermediate, and Basic Tech Users alike.

Among Advanced Tech Users, 51% use their app for transactions, while 36% focus on budgeting. Only 8% use it for investing and around 3% for crypto or loans.

Intermediate Tech Users lean more toward budgeting, with 48% using their app for expense tracking and 32% for daily payments. Smaller groups use it for crypto (9%), investing (9%), or international transfers (2%).

Basic Tech Users rely most on budgeting—69% use their app to manage expenses, only 10% for payments, and about 8–10% for investing or crypto.

51% of Advanced Tech Users use their app for transactions

48% of Intermediate Tech Users use it for budgeting

69% of Basic Tech Users use it mainly for budgeting

8–10% across all groups use it for investing or crypto

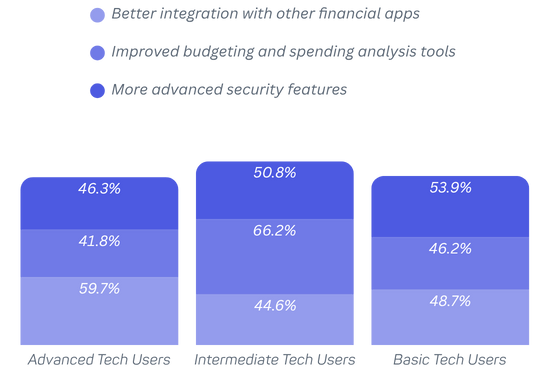

Top Features Still Missing from the Main App

Across all tech levels, the most commonly missing features are security, integration, and budgeting. These gaps consistently drive users to adopt secondary apps.

Advanced Tech Users are most likely to seek advanced functionality. About 60% want better cross-platform integration, 46% stronger security, and 42% richer budgeting tools. Other gaps include rewards (25%) and multi-currency or international capabilities (15% and 9%).

Intermediate Tech Users most often miss budgeting tools (66%), followed by security (51%) and integration (45%). About 31% cite rewards as missing, with fewer naming investment or crypto tools (8–14%).

Basic Tech Users mainly flag security (54%), integration (49%), and budgeting (46%) as lacking. Around 36% want better rewards, and 20% would like simple investing features, though few expect more advanced options.

- 60% of Advanced Tech Users want better integration

- 66% of Intermediate Tech Users miss budgeting tools

- 54% of Basic Tech Users say security is lacking

- 36% of Basic Tech Users miss rewards programs

Explore the full release and visual highlights

Get the official press release and view key data visualized in infographics designed for media use and sharing.